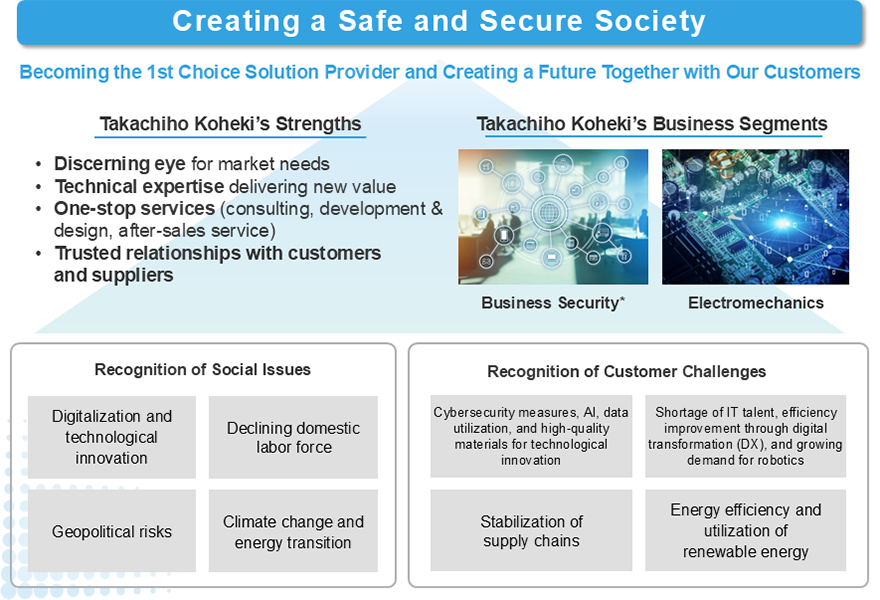

Takachiho Koheki Group has formulated and announced its New Medium-Term Management Plan 2025-2027: Security. Solutions. Synergy. Moving to the Cutting Edge of Evolution with Business Security and Electromechanics, with the fiscal year ending March 2028 as its final year.

New Medium-Term Management Plan 2025 – 2027 Security. Solutions. Synergy. Moving to the Cutting Edge of Evolution with Business Security and Electromechanics

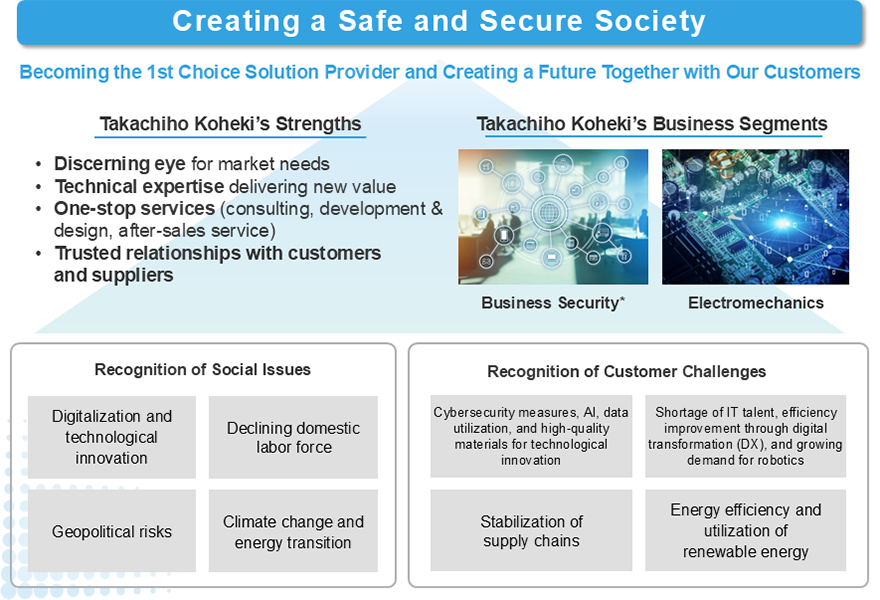

Vision for 2030

We define the security field—one of our strengths and a growth market—as “Business Security.”

We define the security field—one of our strengths and a growth market—as “Business Security.”

Click to enlarge

Medium- to Long-Term Growth Vision

Overview of Our New Medium-Term Management Plan

Medium-Term Slogan

Security. Solutions. Synergy.

Moving to the Cutting Edge of Evolution with Business Security and Electromechanics

Basic Policy

Business growth through focused investment in priority businesses

Creating a new future and value together with customers

FY2027 KPI

Operating profit 3,000 million yen, Profit 2,000 million yen, ROE 10% or more

Business Strategy

Aiming to Become the 1st Choice Solution Provider

Business Segments

1. Business Security Segment

Achieve safety and security in physical and cyberspace through total security solutions

2. Electromechanics Segment

Expand sales scale in the semiconductor business and enhance added value by strengthening technology development capabilities

Basic Strategies

Basic Strategy 1: Evolution of loyal customer strategy

Strengthen internal cross-functional cooperation and provide multi-product services across organizational boundaries

Basic strategy 2: Growth of service business

Create new solutions and enhance added value together with customers

Basic strategy 3: Strengthen new business and global expansion

Basic strategy 4: Implement 6 billion yen growth investment

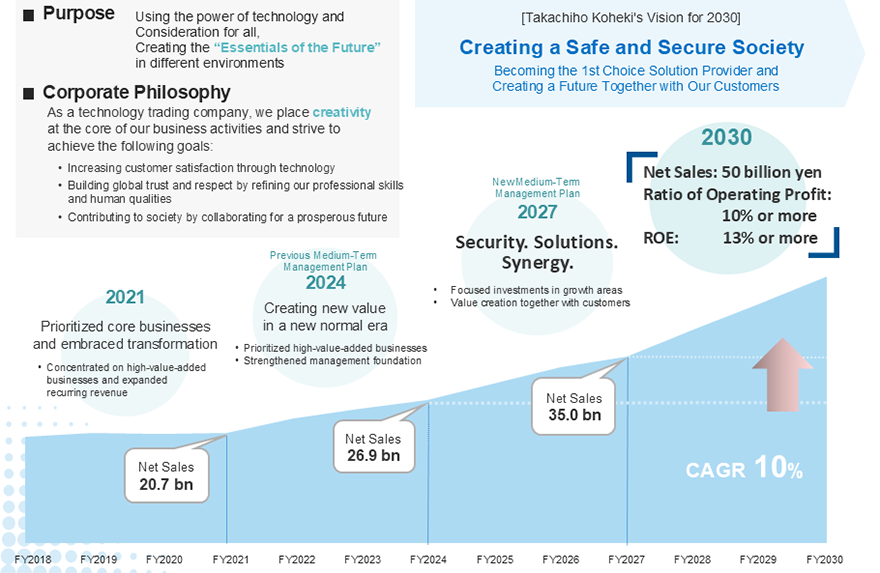

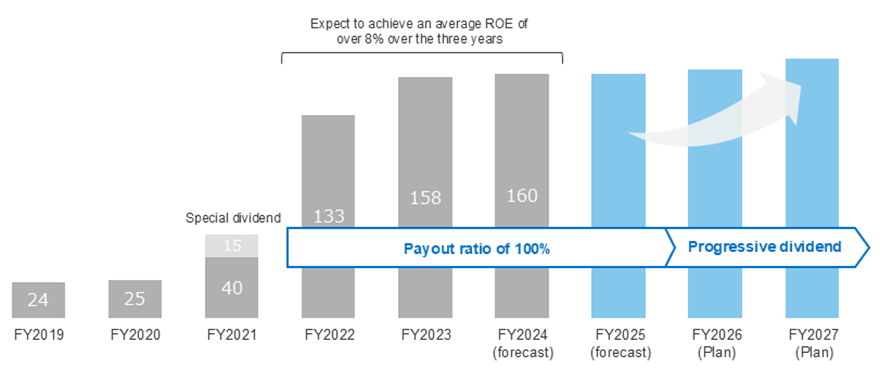

Capital Strategy

Balance growth investment and shareholder return

- In the first year, maintain a dividend payout ratio of 100%, from the second year onward adopt a progressive dividend system to ensure stable shareholder returns

- Improve the cash conversion cycle and profitability of capital by promoting ROIC management

- Promote business portfolio management

Sustainable Management

| Environmental Sector (E) |

- Respond to environmental issues through business

- Respond to climate change

|

| Social Sector (S) |

- Promote human capital management

- Introduce initiatives to achieve a safe and secure society

|

| Governance (G) |

- Transition to a company with an Audit and Supervisory Committee

- Establish an Internal Audit Office and Group Business Promotion Office

- Appoint female directors

|

Medium-Term Management Goals

Numerical Targets

*Figures are based on the criteria before the stock split, which will take effect on June 1, 2025.

Shareholders Return

Basic Policy on Profit Allocation

Based on the capital policy goal of “balancing growth investment and shareholder return,”

- Aim for business growth through active investments while ensuring financial soundness

- For the fiscal year ending March 2026, maintain a 100% payout ratio, and adopt a progressive dividend system from the fiscal year ending March 2027 onward

Annual dividend per share (yen)

*Figures are based on the criteria before the stock split, which will take effect on June 1, 2025.